Sharebox payment solutions boost revenue for car dealerships and workshops

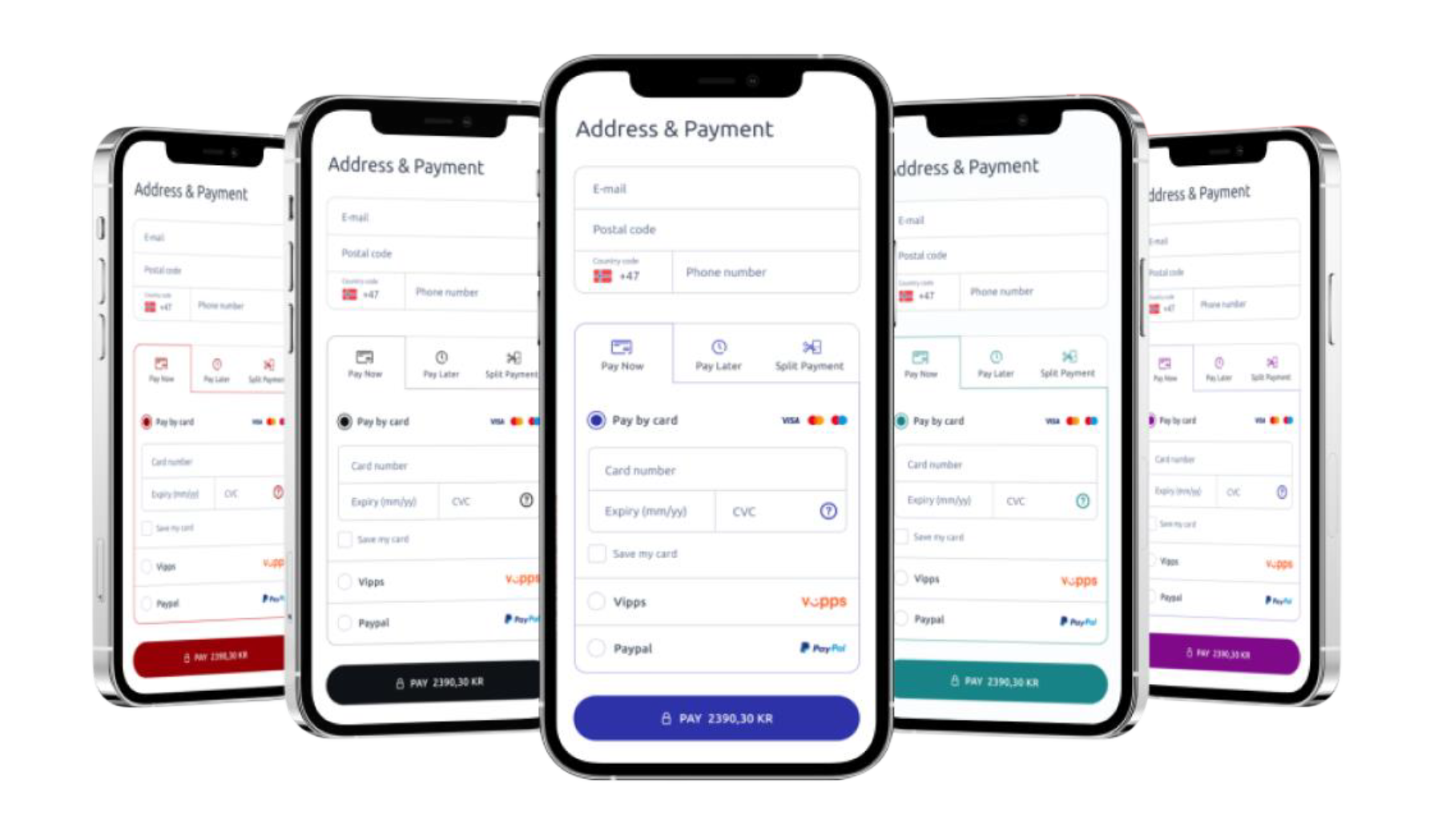

In the automotive sector, especially within DACH/Germany's precise and quality-driven market, the seamless integration of Nexi payment solutions with Sharebox' innovative self-service technology marks a significant leap forward for car dealerships ...